Good Morning,

The analysts and reporters are of the opinion stockpiles at ports are 'yet

again' too low and there's a sudden need for restocking. One would be wise to

consider how China have managed their supplies, rather than the inaccuracies

that are cited. With spot supply in limited demand, China are a lot better at

managing their orders than what the markets are giving credit for.

The steelhome china iron ore total ports inventory reports a circa 84Mts at

ports. This should perhaps be considered within the normal range, with slowing

demand. Remembering it’s a float for the steel economy and should run between 5

and 7 weeks of total demand. Admittedly yesterday's figures suggest it’s

dropped below 5 weeks demand. There's a simple explanation for the spike, one

that was pointed out awhile back, that being the hedgies have realised that a

lot of commodities have limited physical spot supply.

China has the additional woes for short supply, not only a reduced number of

smaller privately owned iron ore operators coming back online post their winter

break in the north. The supplies that would have naturally be replenished by

internal production are now being sourced on the market via spot supply (the

spike). Amazingly some state owned mines with costs at $70/t+ have been refused

permission to close and source on the international market. The Chinese

government may feel security of supply is required, in addition to contracts

with steel mills and avoiding a massive spike in unemployment.

The Chinese of course may do something about their northern mines (perhaps

'development' Grants) to avoid a growing discontent within the entire mining

sector. With proposals being considered for subsidies in hardest hit coal and

iron ore operators to at least maintain a 'sort of production.' (Direct quote

from a Chinese iron ore trader there!

Thankfully it’s made it very easy to make some decent gains in weeks rather

than months, with spot prices moving 8.5% in 6 trading days at circa

$62.5-63.10/t. There's a risk of limited upside so expect those able to supply

the demand to take some healthy profits!

With Xinchuang Li, (president of China Metallurgical Industry Planning and

Research Institute, & Deputy Secretary General, China Iron and Steel

Association), believes the range will be $55-65/t, implying that the peak seen

on Weds/Thurs of $63/t+0.9% is towards the top of the Chinese industry

consensus (read as wanting acceptable price). One would be wise to have a

confirmed change in direction before speculating.

The hope factors are reliant on the Chinese government increasing spending in

"infrastructure" projects to motivate the economy. This may be a

little optimistic with a shift from manufacturing, property (commercial and

residential) and infrastructure towards service-based industries. Remembering

of course the long-term averages (4-5 years) for iron ore stocks at ports is a

smidge under 90mts it’s not the panic some would have you think it is. One

could argue its almost like the Chinese are fracturing the market!

The positive is Atlas Iron is back in production, even coming out with resources

upgrades, a modest "non-cash

impairment charge on assets, a

royalty relief period and a deal on costs

including capital raising. It’s almost as though Atlas is an entirely

different company! With mining restarting and Mt Webber likely to help reduce

operating costs further. Post reorganisation, it could almost be worth a

punt!

With gossip about Fortescue Metals Group (FMG) in Australia, could they have a

very sizeable Chinese partner at operating level or a take-out; surely Baosteel

have been approved for 43B RMB overseas investment (imply 25% upside if there

was a take-out on FMG). With limited competition in the market for such assets

don't get too over-expectant about the price of a deal, or any deal for that

matter, so being without intelligence it was rude not to speculate on the

stock!

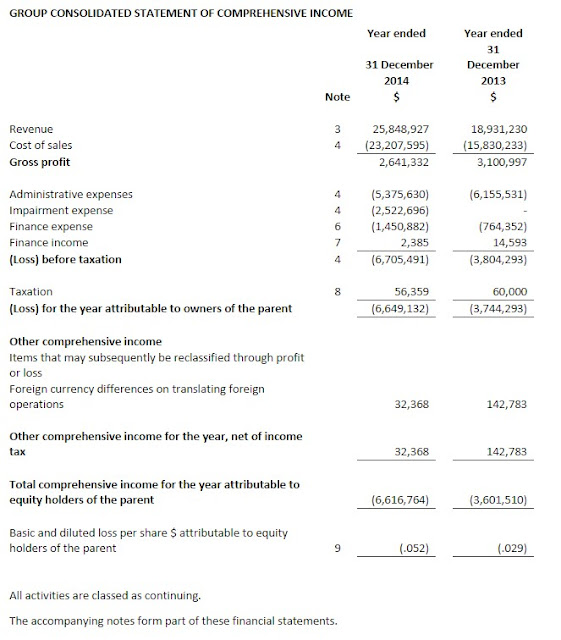

Oxus Plc (OXS) final

results in summary they cannot tell us (shareholders) anything, they

remain confident "of fair compensation" for their claim, and they've

put in a facility just in case it continues for a longer period of time. Quite

what the panel have been doing since May 2014 is anyone's guess. With clarity

on the actions of the Uzbekistan Government, it’s not difficult to assess the

quantum surely! Even as a range, perhaps one would be wise to consider there's

some 'behind' the scenes discussions or cattle trading is going on that 'may'

have delayed the outcome!

Having not "bothered" much with Minco (MIO) for some time (EMC: July 2014) the Q1 Results aren't really anything to get too excited

about. The currency gains should have been expected and the cash on hand and

value of investments is a plus for those calculator investors and giving

appreciation to the SP today.

What the market should consider is the possibly development of Woodstock being

considered by a Chinese entity, with some "potential" upside.

Supported in part by cash MIO has potential prospects at long last. After near

a year with little price movement, the 'tide just could have turned for

MIO" if they can complete on a deal. It would be an astute move by Hongxin

Group in terms of a currency hedged producer outside of the Hubei

province. With a deal last year in the Ukraine, it’s not beyond reason that

a Canadian project could have strategic importance.

Atb Fraser