Good Morning,

The past few days have been rather silent, for a number of

reasons. It’s best if readers see the disclaimer,

which is already covered by Google's "disclaimer about

content." In the event parties disagree with the disclaimer either of

EMC or Google then they should close the webpage and not return.

SGZ came out with a resource upgrade on their Cononish

Gold Project (in Scotland not as some think Ireland or Cornwall). SGZ

have increased their resources by revising their Mine Development Plan, en par

to a Prefeasibility Study. One got all excited about the announcement and share

price to look for the borrow to short, sadly there's zip! Even retailer spread

bet firms couldn't/wouldn't! Although it was intraday greed! Purely on a belief

of an unjustifiable appreciation in the SP, normality has since returned.

Anglo Asian Mining final

results, continuing on from the director loan from EMC

22nd May 2015 Director Loan AAZ's going concern is a tricky statement.

Its common-sense the AAZ's forecasted cash position and ability to repay debt

have a number of assumptions.

- Achieving the forecast production of its gold production operations, principally its heap and agitation leaching; [Also an assumption about grades and recovery should be considered].

- its gold price assumption; and [it’s difficult to validate that gold price assumptions as the all in associated costs per ounce appears absent].

- the small scale flotation plant being commissioned on time and achieving its planned performance. [Crucial].

With some sensible rearrangements in the debt repayment to the

Bank of Azerbaijan (IBA) it is a going concern. With cash at the end of the

year at less than the price of a semi in London, it’s no wonder the director

loan was organised, and in hindsight, one could have argued a higher %

should have been charged.

One doesn't envy AAZ if their grades drop below 3g/t as

costs will increase and thus impact on cash flow. Personally, AAZ require circa

$10M in capital to improve the balance sheet, and in an ideal world $20M would

be welcome. The leveraged play at the current levels means they can survive as

long as IBA are willing participants.

EMC estimated of cash costs were a little conservative at

near $945/oz AAZ have come in at $971/oz. Simply put, it’s not

without its risks, if one assumes they can continue with grades above 3g/t,

keep cash flow positive, floatation plant on time, budget and working properly,

improving recoveries, oh and the gold price remaining stable. Please remember,

every Chinese person and their dog is favouring equities (no doubt leveraged)

over gold and increased supply in the gold market. It doesn't sound that great,

especially with net debt of $52.4 million.

Kingfisher (KGF) came out with Q1 trading statement. No change in sentiment here, one

just needs the buyback to end and the realities of poor trading and conditions

in France (the acquisition or lack of may have been very fortunate to

KGF).

Screwfix are still cannibalising revenue from B&Q, one

wonders whether KGF would be better shrinking B&Q stores and farming space

out to other providers whom don't duplicate the offering. Perhaps something for

supermarkets to consider or...car sales or similar? Gyms? This would maintain

Screwfix in growth and costs seem to be easier to control and traction in the

market making it the shining star.

KGF are quick to point out about margin improvements,

although on the comparative period this would not be hard! UK gross

margins up 90 basis points reflecting weak comparatives (-210 basis points Q1

2014/15) due to more promotionally-led showroom sales last year.

One has to wonder whether KGF's costs focus is something

they shouldn't be echoing to the market, more so maintaining efficiencies.

Costs benefited from on-going productivity initiatives offset by phasing of

marketing costs. Could Kingfisher benefit by cancelling their over 50's

discount scheme that appears not to be abused by anyone whom can grab a

granny/granddad. It does not promote loyalty, it just promotes abuse of the

system!

Its somewhat hilarious commentators and the press are

suggesting the handyman is driving sales with a belief all these workmen are

disappearing off to Screwfix. Having been in a Screwfix recently, its

surprising the lack of trade, although Screwfix are enticing trade with free

tea and coffee when picking up goods.

Simply, the punters have realised the catalogue model is

easier, you don't have to walk round a huge great bloody warehouse to then ask

where such and such valve is. For heavy materials or plants there's a difference,

simply put, for tools and "Screwfix's" key market, you're better off

getting someone else to get locate and organise your order for no charge.

Screwfix simply meets the three C's of Convenience,

Consolidation and Conservation of time, in terms of marketing. As always, ones

very foolish to bet against share buybacks. Today was merely aiding closing the

longs as the market laps up the premium applied to the buyback that in reality

shouldn't purchase any stock above 325 pence.

Iofina (IOF) popped their final results out yesterday. There's a big difference

between positive EBITDA and operating profits. Global iodine prices have

continued to be under pressure, we'll ignore SQM (Sociedad Quimica y

Minera S.A) issues as such, on the basis they have a very different

balance sheet and muppets seem to think it’s relevant. So save for comparing

margins or performance within sector the EBITDA figure (or lack of) is like a

chocolate teapot for a developing company.

Iofina hope by 06th June they should be in a position to

update fully on the Atlantis Water Depot Project. With a high probability

of being granted the permit, it would be rude not to have some binary money on

the possibility for high risk exposure, although IOF's downside may deter some

speculators!

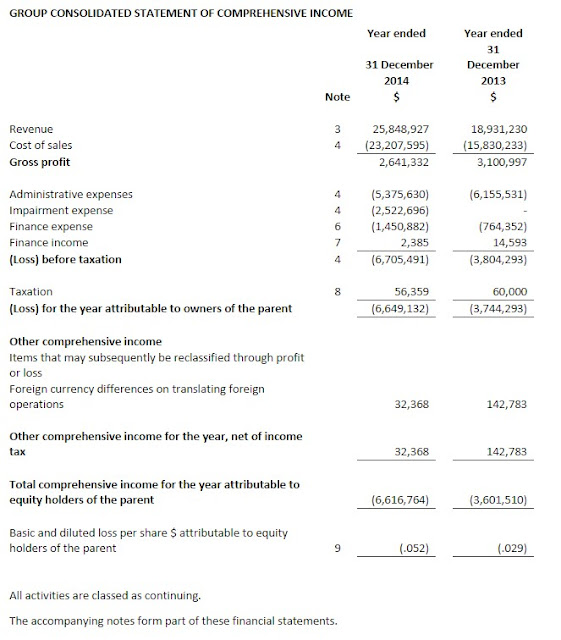

We'll leave Iofina to summarise their accounts, record

revenue, record loss...hmmm

Atb Fraser

Fraser- Hi- back now- nice disclaimer!! I did start to read it and then felt really drowsy... still if it keeps the show on the road, so be it.

ReplyDeleteRe IOF- Yes, they are in a horrid market now, with iodine down from $45/kg to $30/kg during 2014 and whilst they end 2014 with $6.9m in cash, its fairly certain this will be much lower now (perhaps halved if my fag packet is right). They write off $1.2m re IO#1 and $1.3m re the Atlantis Nat Gas project (quite separate from the Atlantis Water project) and they have made it clear they will need funding re any new developments (Atlantis Water and new iodine brine sites) so perhaps their future is all dependant on the iodine price bottoming out in mid 2015, as they have suggested. They cant have another year at these prices by the look of it.

Re FOGL- they hit oil at Isobel but only get around a third of their 70m target zone drilled before they have to call it a day, partially due to high pressures, which is v positive but which means they need another drill to get a full deposit depth and they also need a flow test in due course. Its all intriguing as the hint that it could connect to other Sea Lion fields, which are 25km away and that would make this a massive hub to develop. Still they seem to hit oil on a regular basis in this area (9 out of 11 drills) so PMO will need to look again at their capex and see if they can move it up their schedules.

http://www.rockhopperexploration.co.uk/rockhopper/operations/falklands/maps.html

Cheers. The Leggie